Seeing opportunities in decentralised finance previously unseen in traditional finance, Tesseract Investment, a front-runner on the digital asset space, launched one of Northern Europe’s first decentralised finance research teams. The team intends to capitalise on the investment opportunities that simply do not and cannot exist in traditional finance.

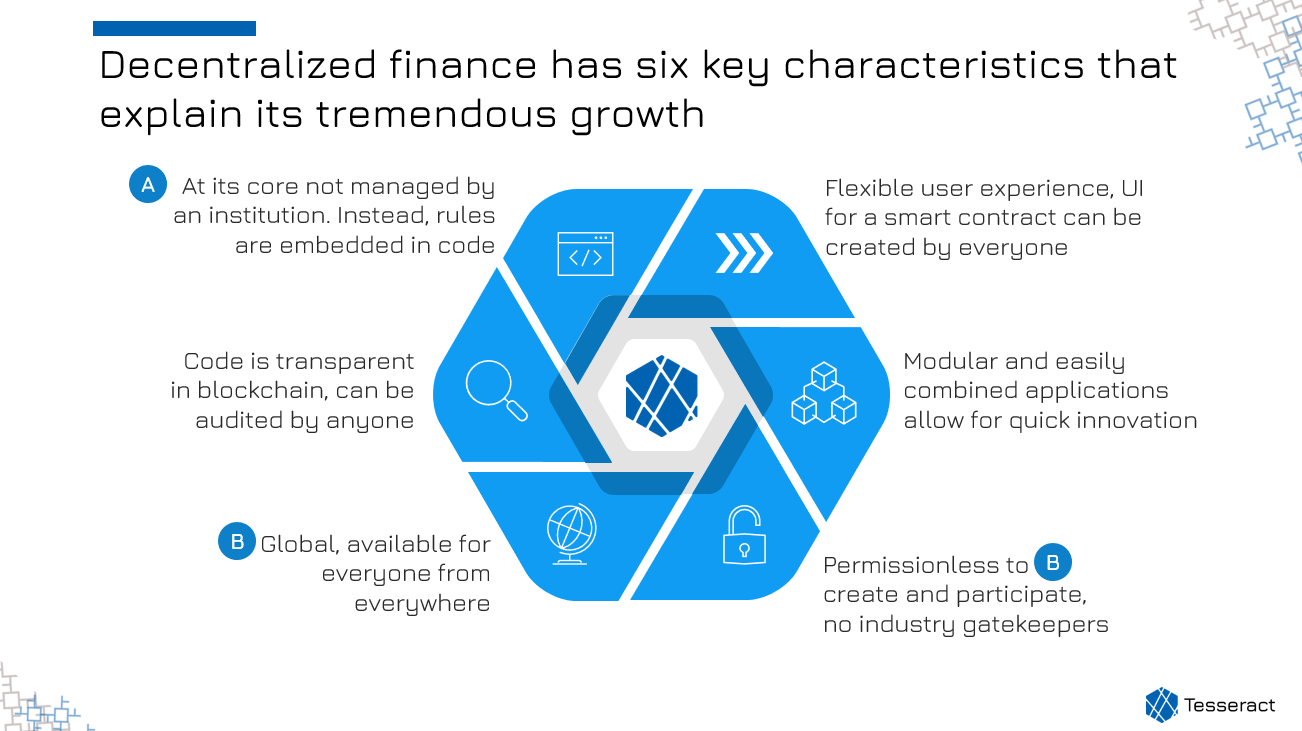

Decentralised finance, or DeFi for short, consists of different financial applications that utilise the same blockchain technology as the cryptocurrency Ethereum. This technology allows everything to work in a decentralised manner, where no single party has control of the platforms or funds.

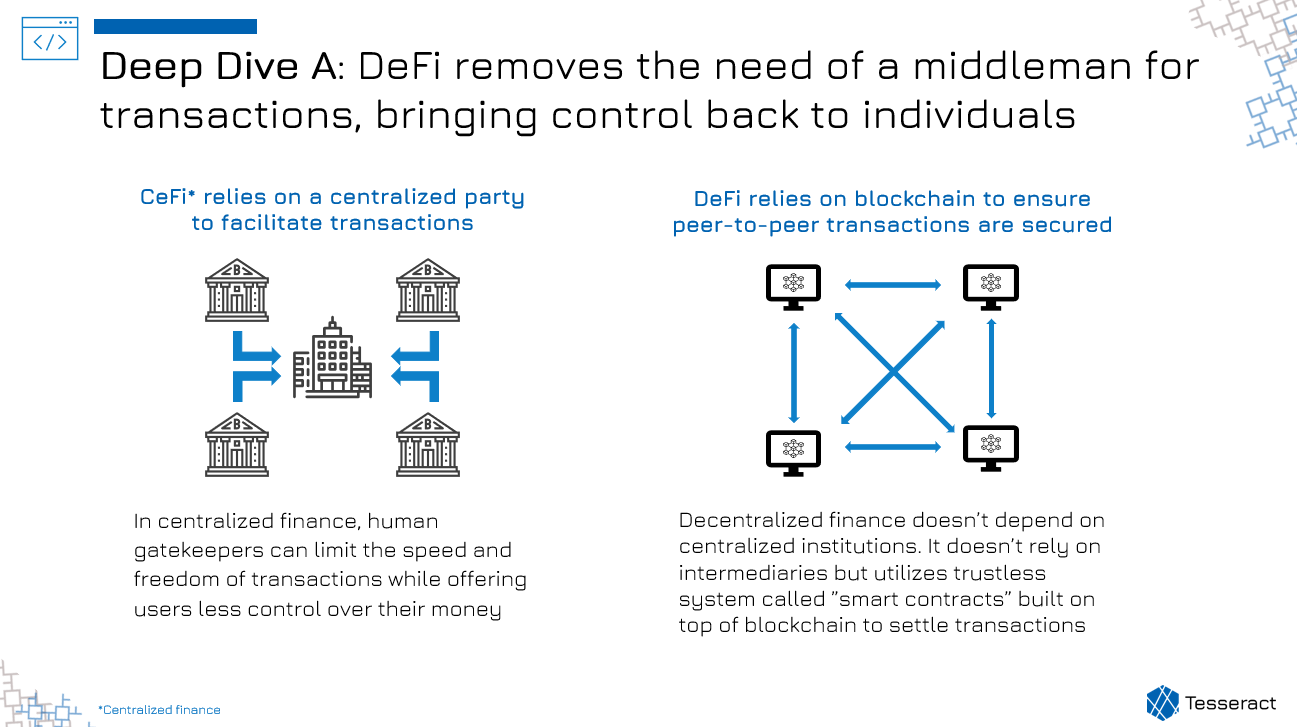

In the traditional world, information about your bank account balance is stored in the bank’s servers. In DeFi it is stored in the blockchain and therefore in every computer that is running an Ethereum node. Because of this, you can work with a counterparty without validating the counterparty yourself: the technology on the blockchain makes sure that they fulfil their end of the deal. The decentralisation also lets you have more control of your funds, as no single party can hold them hostage in a bank account. In centralised finance, human gatekeepers can limit speed and freedom of transactions. In DeFi this is simply not possible.

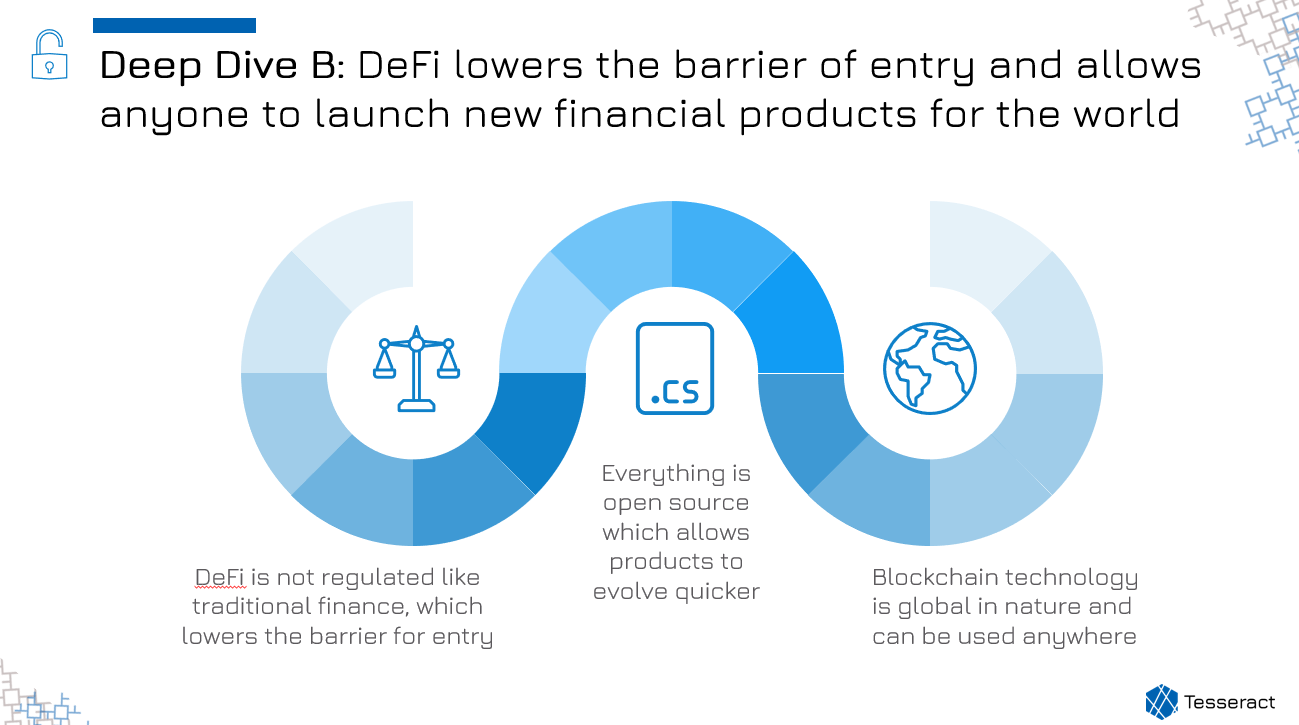

DeFi is significant not only because it allows for trustless interaction and democratises finance but also because of the technological possibilities. DeFi lowers the barrier of entry in finance and allows anyone to launch new financial products for the whole world to use.

This is made possible by multiple attributes. First, the regulation-based hurdles are much lower compared to traditional finance. Regulation moves usually slower than technology and, in this case, it has allowed applications to happen that would require both countless hours from developers but also lawyers in traditional world. Some might argue that lack of regulation is a bad thing, but it also allows for insane speed of innovation. If the rise of fintech has been disruptive to finance as an industry, in our opinion DeFi will blow it to whole another level.

Secondly, DeFi is open source. When new innovations instantly become available to everyone, the cost of improving previous iterations is drastically lower. If you use an exchange in traditional world and you see it lacking a feature you would appreciate, you are not going to fork it (copy the source code), add the feature and start running it as a separate entity. In DeFi, that is actually a viable thing to do. This allows for iterative innovation process where new version has minor improvements made to it but over time they accumulate and make a huge difference.

While DeFi might sound like being just a rebellious movement against traditional financial institutions it is not the case. DeFi has already reached wide adoption which is growing quickly. Over the last year, asset locked under DeFi has increased tenfold going from ~400M to over 4B as of late. We estimate DeFi could go easily over 10B by the end of the year.

DeFi has established a solid foothold in the crypto community and more people are seeing the potential. DeFi is now where crypto was few years ago and there is lot of room for growth. Tesseract sees enormous potential in opportunities in the DeFi space. We have explored different platforms in DeFi for the past year and seen ambitious attempts to establish new solutions fail while also witnessing rise of platforms that now dominate the scene.

“DeFi allows for new applications that are not even possible in traditional finance. Flashloans that Aave offers are really interesting conceptually.” – Phuc Tran, Lead Architect

We see that there is still room for much innovation and speculate that some common concepts in DeFi will also eventually arrive in centralised finance. One of those concepts is tokenisation of different assets, where the ownership of an asset is represented as a virtual token. It allows for easier checking on ownership and divisibility, but also creates possibilities like using it as cash equivalent or sharing resale fees.

Currently we at Tesseract are exploring different DeFi products that offer a yield on crypto assets. For instance, we’ve been testing out Yam.finance and Curve.fi. Ethereum 2.0 is also something were eagerly waiting for as it makes everything more scalable. We have also been keeping track of new decentralised exchanges to see what kind of solutions are offered for automated market making as we think those as interesting concepts and want to understand the moving forces better.

In the near future, we see Tesseract launching its own DeFi vehicle, which would allow us to manage our clients’ funds and allocate them into different DeFi strategies. We feel that as interest in DeFi grows, more and institutions are willing to add that exposure to their portfolios.

“DeFi is the future, when you can replace middleman with technology, you create value. DeFi is an extreme example of that, finance without a middleman” – Ilkka Salo, co-founder of Tesseract Investment